marketingland.com

Columnist Thomas Stern discusses best practices for video advertising across a wide variety of platforms and channels, including mobile, display and social.

The expanding reach and connectivity of digital video advertising provides marketers with improved outlets for engagement.

Increasingly, consumers are cutting their ties to traditional media and turning to digital video for discovery, entertainment and brand awareness.

BI Intelligence reports that in 2016, digital video will reach nearly $5 billion in ad revenue due to developing delivery channels, amplified engagement and the highest average click-through rate (1.84 percent) of any digital format.

Cross-channel video advertising has transformed how brands reach users at key points of the customer journey and influence conversions with highly engaging media. Digital video advertising empowers brands to build stronger connections along the path to purchase with niche-focused content delivered across an increasing variety of digital channels and connected devices.

Over the last few years, research firms such as eMarketer have tracked the maturing value of display advertising, noting extensive growth across all digital channels since 2013. Display ad spend from video, banner ads, rich media and sponsorships is set to

surpass total ad spend for search advertising this year. This shows that marketers are flocking to more visual and connected forms of advertising that adapt to changing user behaviors.

Today’s users expect advertising to be brief, targeted and convenient. Consumers engage with content at a feverish pace and scroll past ads that fail to capture their attention.

Video advertising creates a more stimulating environment for consumers by meeting their expectations for content. It allows brands to quickly inform and visually entertain, which generates a powerful platform for conversion when accurately targeted across user behavior patterns.

In this article, I offer marketers some insights to help leverage a variety of targeting opportunities and delivery techniques to create effective cross-channel video advertising campaigns.

With integration throughout content networks, brands can deliver extremely relevant, engaging videos to users across social, mobile and traditional outlets — improving brand awareness, conversions and retention.

Don’t surrender your market share to competitors. Expand your digital reach with video advertising that connects your target audience segments with the digital content experiences they desire.

Cross-channel video impacts purchases

The structure of video advertising is changing as the range of digital content continues to expand. With more channels for delivery and improved targeting features, video advertising now allows brands to reach audience segments across their preferred platforms to stimulate the highest levels of ROI.

Cross-channel video campaigns connect with users across websites, social networks, mobile devices and connected TVs, delivering content fluidly along different touch points of a consumer’s journey. This increased exposure with engaging, targeted content positions brands for purchase in an increasingly competitive landscape.

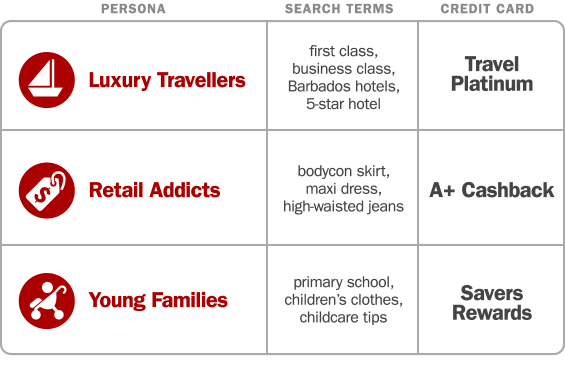

Imagine the progression a user goes through when making a big purchase like a car. They initiate the process by building a consideration set of possible brands and models that fit their needs. As users collect information across relevant and trusted sources, video ads can reach users on those sites with content targeted around the needs specific to different stages of search (such as product information or nearby stores). Additionally, video ads can reactivate a user’s search by connecting during lulls in their research process with social, mobile and programmatic TV advertising.

Successful cross-channel video advertising campaigns will reach users with targeted content across their entire path to purchase and identify their point of conversion. Actionable exposure can aid conversion whether users encounter video display ads on trusted websites, in-stream videos from their mobile device, sponsored content across social networks or targeted video content displayed across connected TV devices.

Visibility at each of these touch points allows users to build trust and awareness with your brand. Enhance your overall value with connected strategies in each of the following video platforms.

In-stream video advertising

In-stream video ads display content within a video player before, during or after a piece of video content. This is a great way to target niche audience segments already searching for video content to solve a need.

Typically, 15- to 30-second pre-roll video ads are used to display an advertisement before a video begins.

According to Google, these ads are most effective when focused around branding, as conversion rates are often lower than with other forms.

Keep your message tight, and offer value to users with as little disruption as possible. Many in-stream ads can be skipped after five seconds, so convey your message quickly, and incorporate strong calls to action early in your video.

Direct traffic from your ads to additional video content on your website to foster a user’s video experience and further stimulate engagement. Ensure that you create a positive experience for users by directing traffic to relevant landing pages that correlate with the targeting used initially to trigger a view. Incorporate remarketing code on your landing pages to continue delivering targeted ads that grow awareness and stimulate conversion as users move around the web.

Display video advertising

Advanced audience targeting allows your brand to display relevant video content within banner ads and text links on the sites users already explore and trust. This lets brands piggyback on the authority these pages hold, building trust and driving conversions with targeted solutions.

For example, a user may come to a site to view an article about designer shoes and experience a targeted auto-play video from a shoe retailer in place of a standard banner ad. This can be an effective way to stimulate action from users already engaged in discovery and at key points in their research process.

To be successful, ensure that you and your media buyer have a good understanding of audience segments targeted within campaigns. Align your video content with relevant user interests and websites to improve the impact of your investments. To increase retention and ROI, make your content actionable, with clear value and strong calls to action displayed early within an ad.

Additionally, display ads can be a good platform to draw additional engagement with interactive and expandable media that rewards users who click to learn more.

Social video advertising

Social media networks offer a unique platform to deliver video content that goes beyond promotional advertising. Unlike in-stream and display advertising, videos advertised within social media channels are inherently more shareable, as they are well integrated within the content users have come to interact with. Additionally, sponsored videos within social networks often look very similar to organic content and are equipped with additional features that allow users to share, like and discuss.

Most social platforms allow marketers to share videos directly in the news feeds of targeted audience segments, which can stimulate additional reach organically. Create video content tailored around the detailed user interests and demographics accessible in social channels, and leverage paid amplification to heighten exposure and engagement.

On some social networks, marketers can choose to have videos silently auto-play. Adapt content to offer value and stimulate interest without sound.

According to a study from

Locowise, viewers on Facebook watch videos for 18.2 seconds on average, despite the average video length being 55.3 seconds. By incorporating compelling content and imagery within the first three seconds of videos, brands can increase viewing and retention rates from social videos. Furthermore, make sure your thumbnails are compelling enough to encourage users to stop scrolling and engage with your content. Combined, these tactics can lower your cost per acquisition and enhance conversion rates.

Mobile video advertising

According to

eMarketer, digital video advertising spend will double by 2019 in response to a surge in mobile video. With mobile leading online access, user trends in content consumption have shifted. There is a massive, growing market of mobile consumers looking for quick, valuable and relevant content on the go.

As recent data from Cisco suggests, video is the preferred content platform for mobile users and will soon make up

two-thirds of mobile online traffic. To be visible in such a fast-paced market, brands must adapt to changes in consumer behavior.

Mobile video advertising presents many of the same targeting and delivery options as desktop, with two distinct advantages. First, studies from Google and Ipsos have found that

mobile video holds more attention and provides additional opportunities for real-time engagement.

Second, 68 percent of video on mobile devices is non-skippable, according to the

Mobile Marketing Association. This means your mobile views are more valuable and present the opportunity for higher completion and click rates.

To take advantage of this opportunity, keep your videos actionable, between 16 and 30 seconds long, and develop content that adapts to different screen sizes. Additionally, coding videos in HTML5 VPAID allows marketers to run interactive pre-roll/mid-roll/post-roll video regardless of device, screen size or most in-application environments.

Programmatic TV advertising

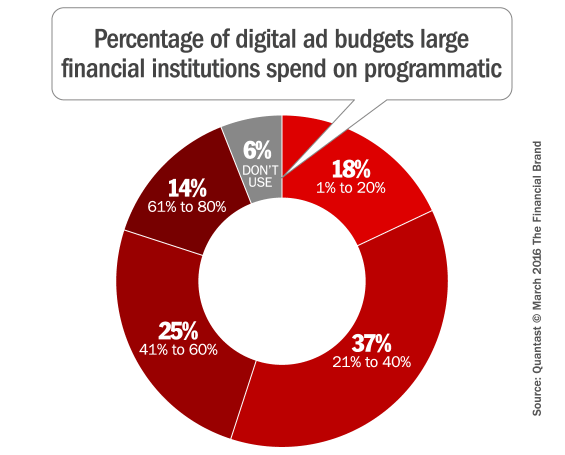

Perhaps the most exciting advancement in video advertising is programmatic TV, which allows marketers to deliver digital video advertising through television sets. Instead of conventional show ratings, this platform leverages advanced audience data to deliver targeted videos to niche segments already engaged with related video content.

Unlike traditional channels, programmatic TV advertising allows brands to deliver highly focused and measurable video content across connected TV, linear TV and addressable TV outlets, creating value and operational efficiency for marketers and consumers.

Create your video content to be flexible with all screen sizes, as users may be streaming from large smart TVs or small mobile devices. Programmatic TV advertising allows for extremely niche targeting to user segments already watching video content and comfortable with video advertisements. Additionally, targeting features expand audience reach, allowing marketers to retarget website visitors who did not convert, competitors’ customers and user segments as they move across devices.

Video advertising best practices

To get the most out of your video advertising, develop a cross-channel strategy that incorporates a variety of delivery methods to engage users at all stages of the discovery process and across all devices.

Video exposure throughout their path to purchase can grow awareness and improve conversion rates. Regardless of your video advertising platform, keep the following best practices in mind:

- Invest in quality production.

- Cater video content to devices and audience interests.

- Leverage audience data to keep content targeting relevant.

- Implement retargeting to track users across devices.

- Pay by view or completion to keep impressions and conversions high.

- Monitor video shares, channel subscribers and site traffic.

- Establish goals in your analytics platform to track online conversions.

- Display strong calls to action at the beginning and end of videos.

- Tell your story with and without sound.

- Incorporating compelling content and imagery within the first three seconds of videos.