No longer a novelty, digital advertising is expected to comprise more than 50 percent of buyers’ total marketing budgets in two years, according to a new report by Accenture.

Digital and mobile advertising spend now equals that of television and far surpasses print, and many respondents for Accenture’s “The Future of Advertising” report feel that soon digital will account for 60 percent of total budgets. While digital and mobile has revolutionized the advertising industry, the transition still presents buyers and sellers with numerous challenges.

“Digital advertising opens a whole new world to reach and engage consumers,” said Gavin Mann, global broadcast industry lead at Accenture. “Analytics are a big part of this.

“Marketers need to create integrated data sources and leverage the appropriate analytics tools and digital skills to make it work,” he said. “This is especially relevant for marketers in the luxury space who are dealing with a niche, specialized audience who know what they like and are not easily swayed.

“Tailored content shaped by analytics is the best way to reach them.”

For The Future of Advertising report, Accenture spoke with executives at ad buyers who represent major brands and ad sellers including publishers, agencies and social/Internet companies in the United States.

Going mainstream

Despite marketers’ increasing focus on digital, Accenture’s research suggests that increased ROI for ad buyers and higher revenues for ad sellers remain elusive.

Despite marketers’ increasing focus on digital, Accenture’s research suggests that increased ROI for ad buyers and higher revenues for ad sellers remain elusive.

Digital has been embraced by marketers due to the lure of greater returns. Indeed, buyers are attracted to digital marketing more so than traditional buys because of the amount of data that is increasingly available.

With data that can help to effectively target a particular demographic there is also a greater return on ad investments. Overall, ad sellers feel that data usage maximizes inventory to result in greater revenues.

Marketers’ desire for greater ROI and revenue has resulted in an increased use of programmatic. Today, programmatic is only used at a rate of 17 percent for inventory, but respondents suggest that in two years this will double to 35 percent.

Accenture found in its research that the buying and selling sides of marketing are having difficulties achieving digital advertising objectives because of a “disparate, patchwork technology environment.” Teams on both sides have not fully integrated data management platforms (DMP) or demand-side platforms (DSP)/supply-side platforms (SSP) with other systems and tools.

This disparate environment has thus made it difficult to improve campaign performance and judge ad conversion rates.

Data has also presented challenges for both buyers and sellers, as they tap into nine data sources to better understand consumer preferences and behavior that can be used to segment audiences. These sources include site analytics, measurement companies, CRM, DMPs, social data, mobile data, consumer surveys, onsite search and subscription data.

Understandably, with too many sources marketers are prevented from effectively using the data at hand, as it also jeopardizes the data quality.

Sellers told Accenture that they are using audience data, third-party data, order data and ad server data, but the data cannot be used effectively because it is too difficult to aggregate and ensure quality due to a lack of analytical tools. For sellers, ROI is also difficult because the source data does not paint a single view of consumers.

Overall, the three primary challenges of consumer data usage for better audience targeting is siloed organization at 63 percent, data aggregation at 47 percent and data quality at 44 percent.

Going forward there will be other challenges faced by marketers. Executive respondents shared that they expect more of a focus on personalized, targeted and valuable ads. This will prove especially true as ad blocking becomes more of a reality.

Essentially, consumers are resulting and embracing ad blocking as a way to tell marketers that they are tired of “the barrage of unnecessary, unwanted, irrelevant messages.” Struggles will present themselves for companies not yet equipped to personalize and target messaging.

“Ad blockers are a relatively new, but growing threat to the digital advertising industry,” Mr. Mann said. “Consumers are increasingly willing to pay for blockers because too many ads are poorly targeted.

“The overabundance of heavy, irrelevant content combined with the technological ease of using an ad blocker has the potential to seriously cut into the revenue models of Web sites and advertisers,” he said.

Increasingly, consumers expect targeted messages that have a degree of value for their preferences and behavior. Going forward, offers should be more holistic rather than relying on standard information such as age and gender.

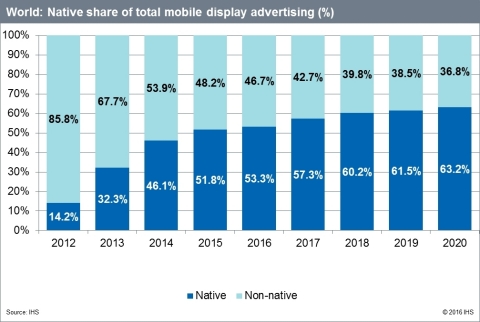

Content-based marketing is likely to be a solution as the format works in an advertiser’s message into compelling content that not only gets the brand’s message across, but also serves a consumer’s need.

For example, brokerage firm Sotheby’s International Realty is providing affluent readers of Elle Décor access to high-end real estate content in a native advertising push.

Led by media agency SwellShark, Sotheby’s launched its partnership with Elle Décor on the Hearst-owned title’s Web site on March 1. The creative campaign uses Elle Décor as a starting point and includes innovative content elements that will then be expanded across Hearst Magazines Digital Media portfolio for broader reach (see story).

Executives also expressed that the way in which ads are delivered also needs to evolve. To do so, the respondents suggested taking an omnichannel, screen-agnostic approach.

Changes

Advertising and consumer preferences and expectations are changing and with that technology is also evolving. These changes will include data and analytics, systems integration and salesforce automation.

Advertising and consumer preferences and expectations are changing and with that technology is also evolving. These changes will include data and analytics, systems integration and salesforce automation.

Accenture found that both buyers and sellers need a 360-degree view of target consumers to improve ROI and increase revenues. Planning a centralized database to manage audience data will help buyers and sellers get the most out of the data available to them.

This is directly linked with better integration practices that include sales force automation solutions across the ad sales process. In turn, this will make the sales team more efficient through a single solution rather than a fragmented approach across tools.

Together this creates a closed-loop system that benefits from an up-to-date, accurate database that holds “the truth” and can be used to make more informed decisions for ad placements based on the greatest returns.

For example, Barneys has placed iBeacons throughout its new Chelsea store to create a personalized experience as well, available for those who opt-in. Using the technology, the retailer can send personalized recommendations sourced from The Window, Barneys’ editorial site, to consumers’ smartphones.

Internally, Barneys’ use of Relevance Cloud is beneficial to its sales team, which can use the platform to connect online and offline behavior and preferences. Access to this data can help sales associates better assist Barneys’ in-store consumers with the retailer’s clienteling application (see story).

Marketers must update their practices to effectively compete with today’s technologies.

“Its impact will be muted if digital advertising organizations change their practices and tailor content to the user experience,” Mr. Mann said. “It’s futile to focus all efforts on trying to outsmart ever-evolving ad-blocking technologies to force audiences to watch ads.

“The industry needs to do everything possible to make ads less of an infringement on precious screen time, by building on early successes that deliver targeted, relevant and entertaining ads – in a creative style appreciated by the individual,” he said.

“Advertisers now have a wealth of operational and analytical technologies to create advertising experiences that are engaging to the consumer.”